The capex cycle is one the most important economic indicators to follow as an investor. In traditional energy it is clear that last year we entered, and are now coming out of, the bottom of the cycle; low reinvestment rates have combined with ESG and absurdly low valuations to create what is shaping up to be a super-cycle on the back of terrifying shortages, high prices, and ultimately a reversion to reasonable valuations for the sector (from companies buying back shares at a furious clip).

We aren’t going to pound the table with the revenge of traditional energy thesis; frankly any professional investor that doesn’t get it by now is never going to get it, or will get it at the top of the cycle. D’oh.

What this series will focus on is how to invest for the next stage of the traditional energy capex cycle; it will differ from prior cycles because it will be less reactive to high market price signals and will instead be driven aggressively by ESG.

Simply put: capex for production may be restricted at the moment, but overall capex must inevitably increase, and dramatically so, either to respond to sustained higher prices resulting from a multi-year shortage, or to fulfill the new post-carbon age requirement to reduce carbon emissions, or both. This transition to a post carbon age will be a monumental reshaping of society that will require global investment in the trillions of dollars.

Our idea today focuses on Western Canada, which will be one of the hotspots of this energy transition given its position as one of the world’s largest traditional energy exporters. This is what capital expenditures in the oil sands and broader traditional energy sector have looked like in Alberta, Canada’s dominant energy province.

2020 was a trough year as capex was slashed to prioritize debt repayment, resulting in production declining ~10%; that capex will need to rebound to 2018-2019 levels to simply keep production stable on pre-Covid levels. However Canada has also added about 1 million barrels / day of additional pipeline export capacity, which will require additional growth capex to fill these pipelines with 15-20% more production across than basin than pre-Covid. Add a massive 2Bcf/d LNG export terminal in Kitimat to the current 16 Bcf/d of natural gas produced in the region, and it is obvious that Western Canada is looking at a number of years of sustained capital expenditure growth based solely off required production growth.

But that is not the point of this article, because while export requirements will return the industry to high levels of capex above the post-2015 crash, production growth alone will not reshape the capex cycle. That will require the new factor:

E.S.G.

Specifically, Canada’s goal to reduce emissions to 40-45% below 2005 levels by 2030. Since the traditional energy industry has grown since 2005, this will require a disproportionate reduction in an industry that now accounts for 26% of the country’s total emissions and which is continuing to grow production. The oilsands on their own account for 10% of Canada’s total emissions, or 70 megatonnes of CO2, and the CEO of Suncor estimated that it would cost $75 billion to achieve net zero for the oil sands alone. The capital costs to get to net zero for the entire Canadian traditional energy industry is likely to exceed $200 billion, of which half must be operational by 2030 in order to give the country even a reasonable chance of reaching 40-45% below 2005 emissions.

The industry will have to slash 104 megatonnes of Co2, almost all of which will have to be capex-heavy projects like sequestration since production-related emissions mitigation is relatively ineffectual. Using the estimated $1 billion / megatonne Co2 capital cost for carbon sequestration infrastructure (ie. Norway, among others) that corroborates industry estimates for more than $100 billion that will need to be expended by 2030, not even accounting for the fact that production is going to increase another 15-20%, necessitating further reductions.

Return to this graph - if the industry were to reach that level of capex by 2030 that would result in $14 billion in extra annual spend from 2023-2030 (much of which will come from the government), a figure that will put total industry capital spending in the ballpark of the boom times pre-2015 after accounting for modest 15% growth capex (~25ish $B 2018-2019).

How to invest in this theme of torrential carbon transition spending will be the subject of this series. But the most obvious choice is a company we have already written about on the private substack: Black Diamond Group (TSE:BDI).

What differs from our older article is the new recognition of how insanely well-aligned all of their businesses are to capital spending in the basin, and how that spending is likely to take off due to both ESG and growth capex. Most investors still think BDI is still torqued solely to production-related capital spending in the basin when the reality is that the core of the company has actually always been torqued to any capital spending. The new reality that investors have yet to comprehend is that capital spending will come from overdue maintenance capex, growth capex, and most significantly of all - carbon transition capex.

Could you think of a better collection of business torqued to the Co2 pipelines, construction sites, intensive Co2 overhauls of existing infrastructure, and carbon injection infrastructure that must be built? (Latest Presentation Here)

Modular Solutions:

“high-quality, cost effective, modular space rentals… [for] construction, real estate development, manufacturing, education and resource industries, and government agencies. Products include office buildings; lavatories; storage containers; large multi-unit office complexes; training and classroom facilities; high security modular buildings with disaster recovery programs; custom manufactured modular buildings; and blast resistant structures”

Workforce Solutions:

“premium, remote workforce lodges and full turnkey services, including remote facility, catering, and hospitality management to customers in North America. Lodges feature executive and VIP-style accommodations, state-of-the-art industrial kitchens and dining facilities, recreation facilities, and internet connectivity.

We also own and operate five open camps in Western Canada: Horn River Lodge, Little Prairie Lodge, Smoky River Lodge, Sunday Creek Lodge, and Sunset Prairie Lodge.”

Lodgelink (our personal favourite / hidden gem):

There are few better positioned companies geared to this capex cycle, which will drive massive construction needs (Modular Solutions) and a massive rebound in the number of personnel performing wide-ranging carbon efficiency overhauls (Workforce Solutions) in every remote place where traditional energy is produced (Lodgelink).

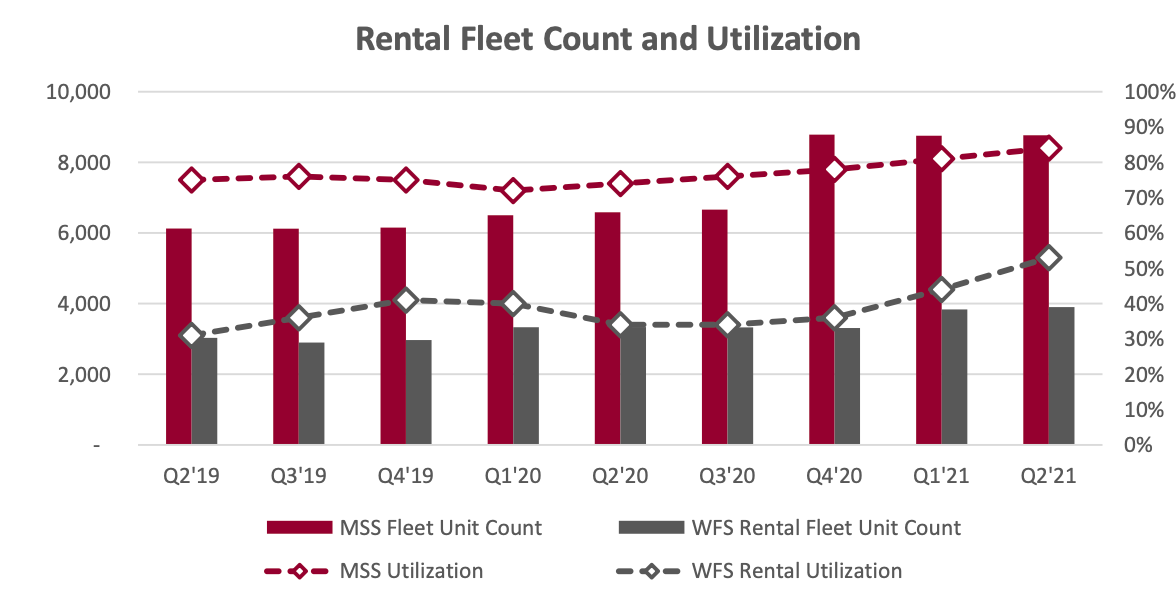

Keep in mind that the company has delivered fantastic operating performance already in the near-complete absence of growth capex in the industry, which used to be the core of its business. Even after a multiyear diversification effort the company still has a large number of assets in Western Canada that are still under-utilized and under-earning, although it has become a smaller part of their overall pie as the other pieces have grown. But that part of the pie is about to get much, much bigger.

That is going to drive revenue and EBITDA from increasing utilization and also from price increases from what is currently a significantly under-utilized and under-earning portion of their business (mostly WFS, but also the MSS fleet in Alberta / Saskatchewan) that already represent 35% of revenues, even with currently low pricing and low utilization, and disproportionately less profit. (WFS Western Canada + MSS Prairies + WFS USA)

We previously wrote,

The leverage that WFS has to capital expenditures

rising oil pricesis hard to understate - were WFS to return to 2014’s 70% utilization levels it would be doing $200m in revenue at a 30% margin for $60m in EBITDA. At 8x that would value WFS at $480m CAD, or $100m more than the entire enterprise value of BDI today.

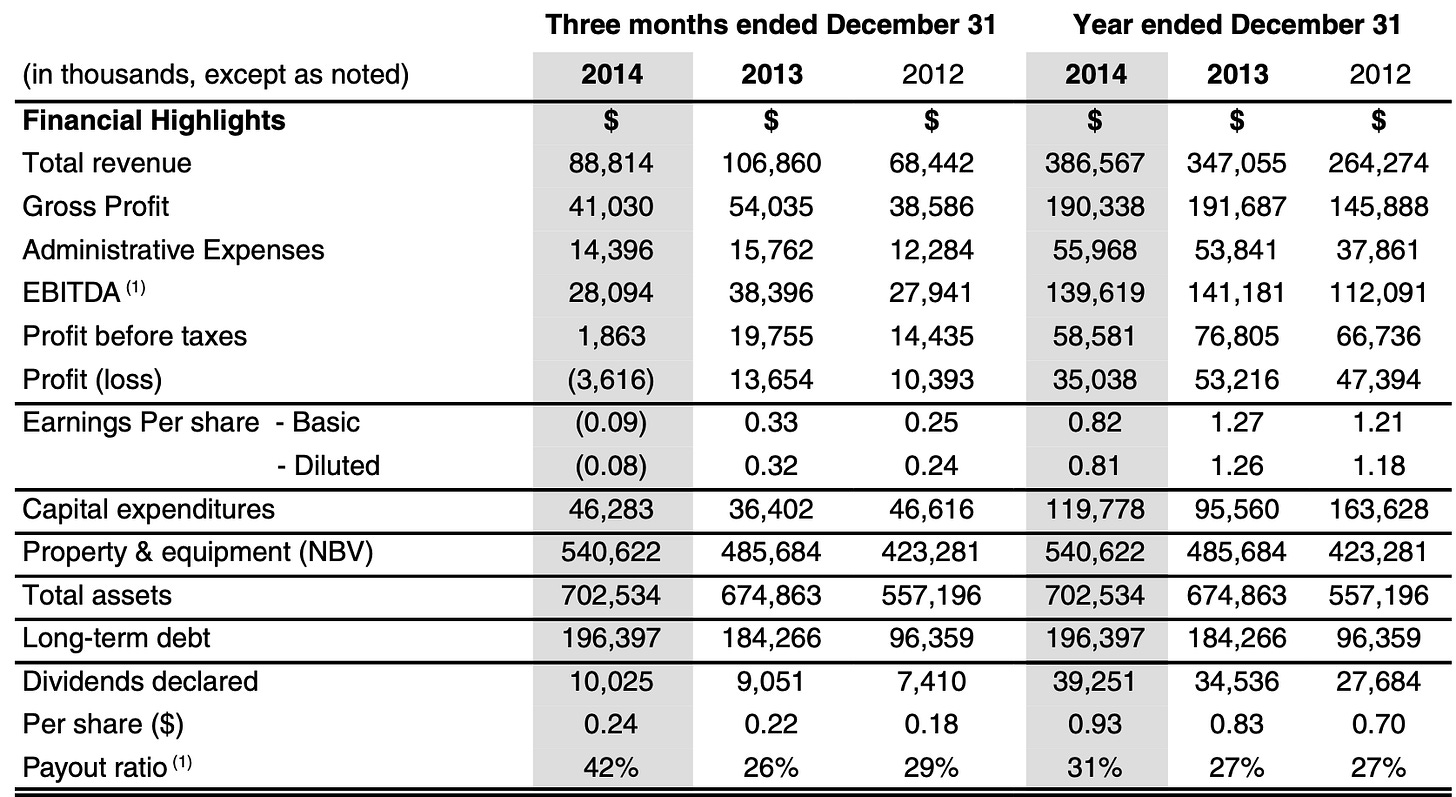

It is increasingly looking like these numbers will be conservative (also because we ballparked 2014 too low). If energy prices remain supportive and the industry + government come even remotely close to the required carbon capex, this is going to set off a demand bonanza across all of Black Diamond’s businesses. For reference, in 2014 the WFS business represented essentially the entirety of BDI - and the peak in the cycle of industry capex. That year the business did nearly $400m in revenue and $140m in EBITDA, and today’s business has expanded and grown to new businesses and geographies such that the current valuation is covered (and then some) entirely by an entirely different business - modular solutions - with WFS and Lodgelink thrown in entirely for free.

Importantly, non-transition capex will be the first catalyst here, as years of deferred maintenance capex will combine with growth capex to drive the first stage of this new capex cycle through next several years. Since government Co2 subsidy plans will be released this spring and the industry will need time to respond and engineer for the first batch of projects, the carbon factor will soon thereafter turbocharge Black Diamond’s medium and long term prospects on top of historic maintenance and growth spending, making BDI one of the few investments currently categorized as ‘traditional energy’ that will benefit tremendously from the post Carbon age. Layer on a still heavily discounted SOTP to comps (below, estimates), and Black Diamond remains one of our favourite and most compelling multi-year multi-bagger investments.

Sum-of-the-Parts as of Jan 30, 2022:

Keep reading with a 7-day free trial

Subscribe to LF Research to keep reading this post and get 7 days of free access to the full post archives.